We view bitcoin as a monetary network implemented in free software and its native unit as a debt-free asset for the digital age. The bitcoin network keeps time (a "clock") via an energy-intensive mechanism ("work"), with interested parties ("partners") operating the network nodes.

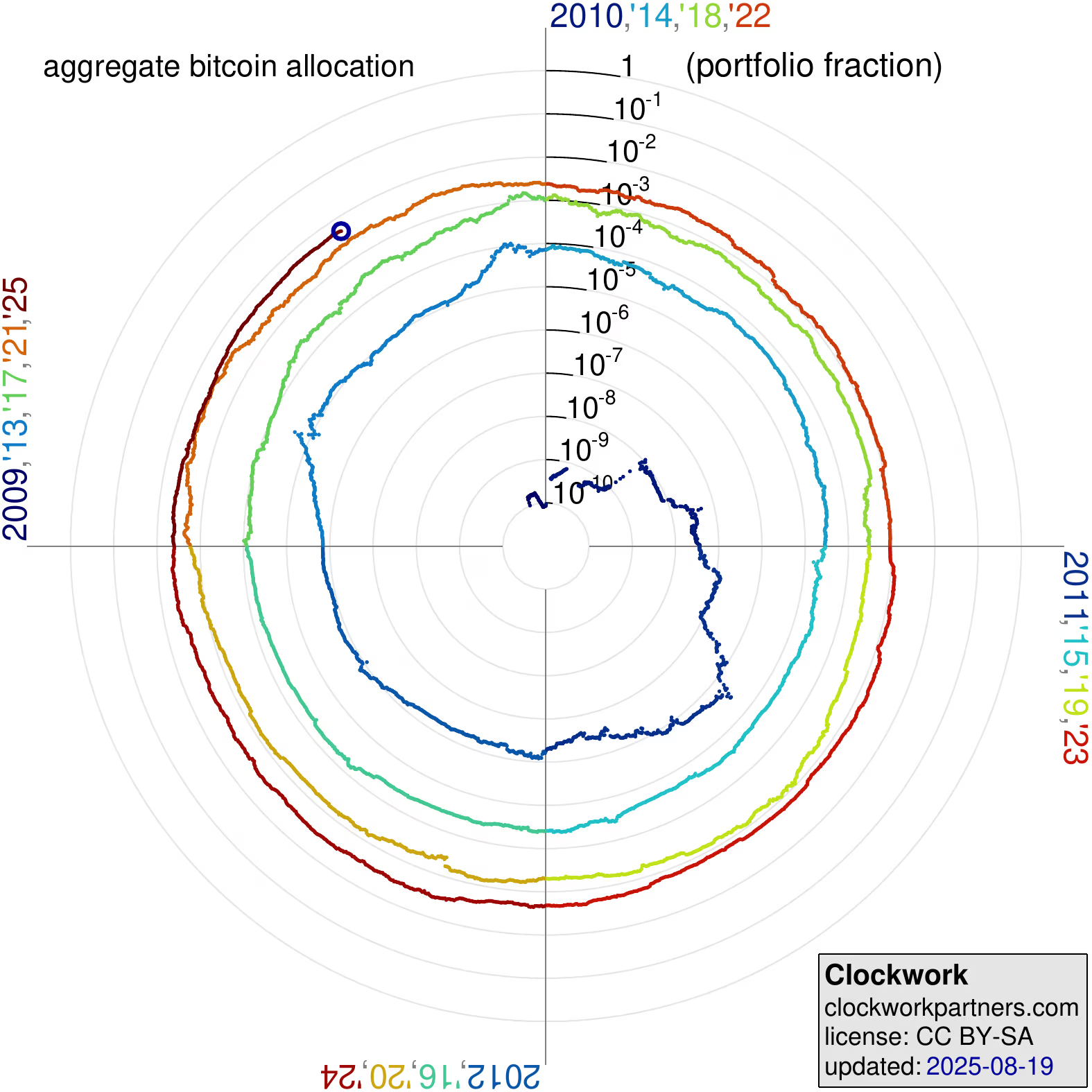

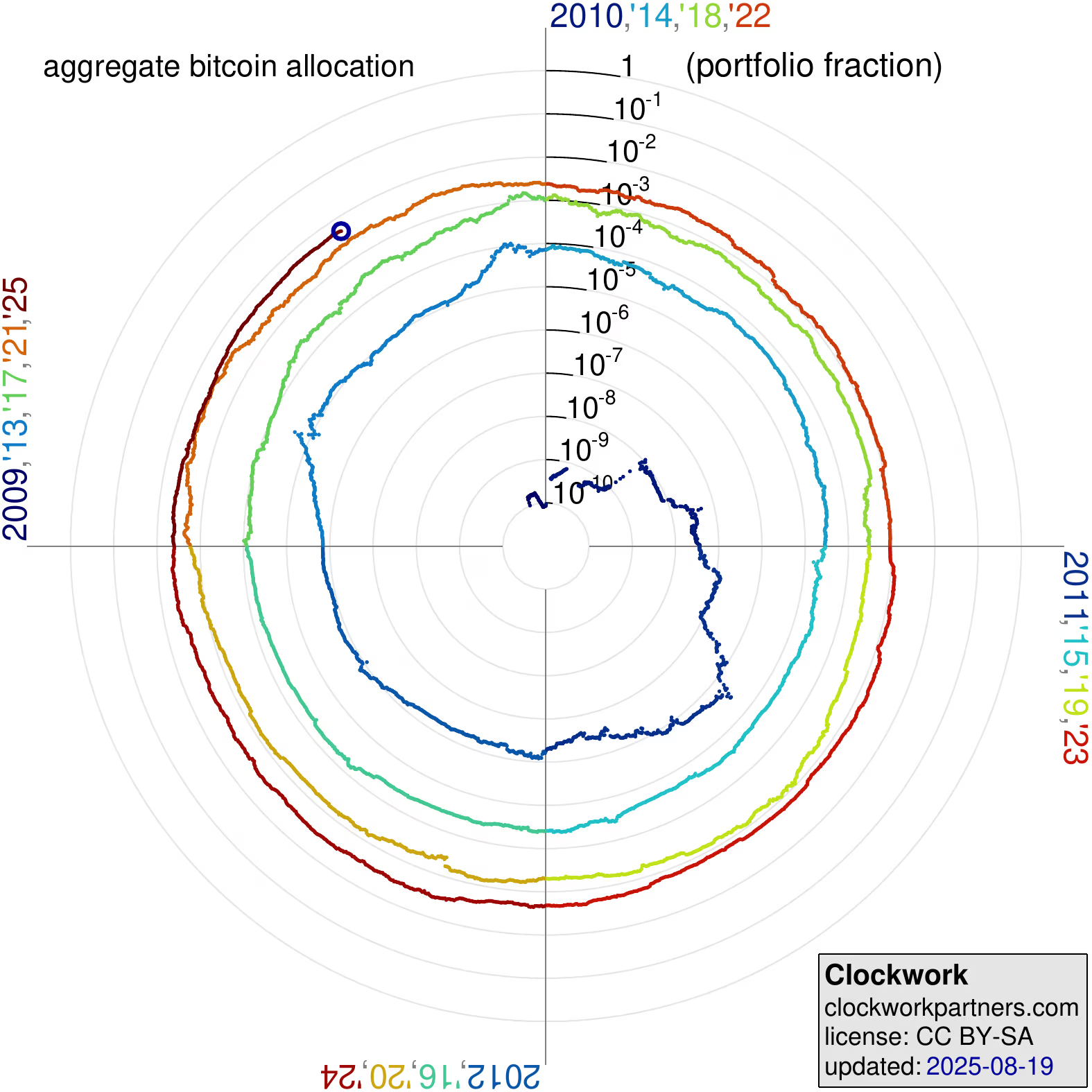

We expect that (a) bitcoin's developers will maintain its security, robustness, and efficiency at the state of the art; (b) bitcoin's miners and node operators will continue enforcing its production schedule as the supply approaches the limit of 21 million (further divisible) units; and (c) people, in aggregate, will increase their allocation to bitcoin.

We propose (a) to visualize bitcoin's growth in ways that highlight its age, its subsidy halving period of (nominally) four years, and its consumption of electricity; (b) to express bitcoin's size as a portfolio fraction rather than a currency-denominated value; and (c) to express asset prices relative to bitcoin.

Formed in 2020, clockwork · partners aims to illustrate the gravity of bitcoin, to develop further understanding of bitcoin, and to evaluate that understanding via investment performance.

The content on this site may be shared and adapted under the terms of the Creative Commons BY-SA license. It is provided for general informational purposes only and does not constitute investment advice or a recommendation of suitability of any investment product, security, currency, or strategy.